सेतो खबरद्वारा प्रकाशित गरिएको हो |

NIC ASIA Bank is one of the most reputed and No.1 commercial bank in the country in terms of brand equity and footprints. The Bank is currently on a lookout for dynamic, result-oriented, pragmatic, self-motivated, and passionate candidates to join us in the following position:

The candidate for this job position is expected to be well-versed with General Administration related activities and is expected to implement all policies and procedures for procurement, cash controls, procurement activities and payments, asset/resource management, logistics management, and general administrative functions. The candidate shall also be responsible for coordinating with vendors for the preparation of a detailed project plan along with a timeline and appropriate execution of projects and ensure completion within the deadline.

The candidate should be responsible to appreciate and accept challenging operation risk management targets and have the ambition to excel. The candidate is expected to support in devising the strong operation risk control mechanism as well as to recommend triggers and limits and report to management about adequacy and effectiveness of the policies, processes, systems, models, and limits and be capable of developing a full-fledged and robust risk management system throughout the Bank for robust risk identification and measurement, risk mitigation and risk monitoring throughout the bank’s business.

The candidate should be responsible to appreciate and accept challenging risk management targets and have the ambition to excel. The candidate is expected to support in devising the strong recovery control mechanism as well as to recommend triggers & limits and report to management about the adequacy and effectiveness of recovery practices and strategies adopted by the bank.

The candidate for this job position is responsible towards fulfillment of Bank’s objective along with positive attitude, desire to learn, motivate the team towards the healthy functioning of the Bank. The candidate shall be responsible to actively search, creatively design and implement robust mechanism to enrich the experience of Human Resource of the Bank.

The candidate should have an ability to plan, develop, evaluate and implement the excellence standards to ensure the employee delight and experience of Human Resources to an excellent level and should have sound knowledge of national and international best practices of HR policies and procedures while having the quality of analytical thinking and proactive approach to work in motivating and creative environment.

The candidate for this job should be fully acquainted with overall banking including International Banking functions. The candidate should possess knowledge of NRB Directives, prevailing laws applicable to financial sector & prevailing accounting standards. The Candidate is required to assist in developing assets and liabilities risk management, value at risk measurement, and trading business plan using an appropriate risk based methodology including any risks or control concerns identified by management.

This position requires working under the oversight and guidance of Head Legal to provide assurance to all the stakeholders regarding the development and implementation of effective strategies, global best practices and instill compliance culture within the bank. The candidate should have good communication skill and demonstrate leadership skill in enhancing the capacity of the staffs as well as legal aspects of Bank. Candidate with working experience in the Legal Function shall be preferred.

The candidate shall be responsible for effective support of Credit Operation Team for smooth functioning of Credit Operation related activities and ensuring that service quality is maintained at desired level.

The candidate must have the ability to strengthen and facilitate aggressive growth of risk assets and up-keeping the bank’s credit cum compliance standards. Candidate must have an orientation towards detailed credit assessment, excellent written/ spoken communication skills in an environment fostering independent credit assessment function of the bank.

The candidate of this job position is responsible for ensuring effective implementation and supervision of all security measures adopted by the Bank by making the entire security system of the Bank more effective. The position requires an ability to identify the risk associated with the implementation of the Bank’s Information Technology Strategy and ensure that the Bank has the appropriate infrastructure to mitigate the risks. The candidate shall be responsible for creating and implementing a strategy for the deployment of information security technologies and monitor security vulnerabilities in the networked systems of the Bank.

The candidate must possess an ability to carry the Bank’s Brand and effectively act as Bank’s Brand Representative. The candidate should possess excellent competitive market and product intelligence and should be able to chalk out instrumental strategies and a roadmap to build a strong relationship with the stakeholders of the Bank. The position involves collaborating with internal and external stakeholders to establish a cordial Banking relationship and should have strong communication and interpersonal skills.

The candidate must possess an ability to carry the Bank’s Brand and effectively act as Bank’s Brand Representative. The candidate should possess excellent competitive market intelligence and should be able to chalk out instrumental strategies and a roadmap to build a strong relationship with the stakeholders of the Bank. The position involves collaborating with Provincial and Local Authorities to establish a cordial Banking relationship and should have strong communication and interpersonal skills.

The candidate for this position is expected to have a proven track record of handling remittance in challenging market conditions. The candidate is expected to ensure day-to-day functions being carried out under supervision in line with the current manuals in force and the laid down operational procedures of the Bank and NRB regulations.

The candidate must have a strong will and energetic sales attitude and is responsible for supporting ineffective execution of the strategies for growing risk assets business under the energy sector. The candidate is required to have a proven track record of achieving the set targets and highly result-oriented. The candidate is expected to implement the marketing plans and campaigns to promote Energy Loans.

The candidate must have a strong will and energetic sales attitude and is responsible for supporting ineffective execution of the strategies for growing risk assets business. The candidate is required to have a proven track record of achieving the set targets and should be highly result-oriented. The candidate is expected to implement the marketing plans and campaigns to promote General Business Loans and customer acquisition.

The candidate requires to be well known about the trade finance and manage operational execution of trade related transactions. The candidate shall be responsible to lead the team to handle the day to day processing of Collections, Letter of credit as part of trade operation team to meet agreed customer service level agreements and review outstanding transactions.

The candidate must have a strong will and energetic sales attitude and is responsible for supporting in effective execution of the strategies for mobilizing individual deposits. The candidate is required to have a proven track record of achieving the set targets of deposits with an eye towards enhancing customer experience and increasing customers’ wallet share. The candidate is expected to implement the marketing plans and campaigns to promote individual deposits and HNI customer acquisition.

The candidate should have knowledge of marketing, branding strategies, online and social media. They should be able to create content and have knowledge of competitor and customer insight analysis. The candidate should be able to manage budget for advertisement and promotional activities. They should be able to align the Banks strategic goals and branding goals. They should be able to plan and execute various branding campaigns and evaluate their effectiveness.

Eligibility Criteria for Assistant Manager

Eligibility Criteria for Junior Officer/Officer/Senior Officer

Instructions to apply:

The candidate needs to apply for a specific position and location as per their preference under the vacancy and multiple applications for the position at multiple locations are also allowed.

Documentary evidence related to qualification and experience shall be sought from the shortlisted candidates.

The Bank reserves the right to reject any application without assigning any reason whatsoever.

Deadline to Apply: March 23, 2021

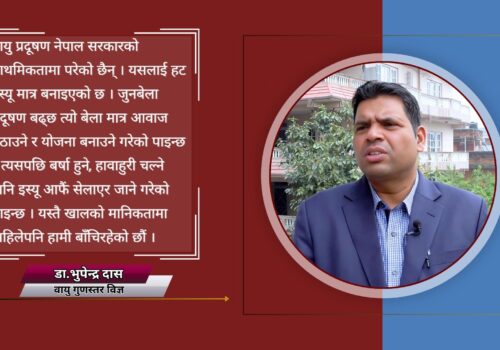

काठमाडौं । काठमाडौं उपत्यकालगायत देशका विभिन्न शहरहरु पछिल्लो समय वायु प्रदूषणको जोखिममा परेका छन् । जसका कारण मानव स्वास्थ्यमा गम्भीर समस्याहरु देखिरहेका छन् । साथै... विस्तृतमा